Standard & Poor’s has warned that anything less than $4 trillion in budget cuts will likely mean the U.S. loses its top AAA rating. So the lawmakers better do something good about this long overdue debt problem, not only in preventing a default but also how to rescue the forever escalating debt. Let’s see what could happen if U.S. is downgraded.

1) A Downgrade

Currently, the long-term debt of the U.S. is rated triple-A (AAA) by Moody’s and S&P (Standard & Poor). In the event of a default, the U.S. rating will be downgraded by a notch or even up to three notch, still far from “junk” status (*Phew*). Still, the baseline expectation from many analysts and economists is that the Congress will strike a last-minute deal to raise the debt ceiling. Even if this happens, it does not take a downgrade away simply because U.S. debt stays and will continue to skyrocket.

2) Interestingly, Investors Will Not Dump Treasury Securities

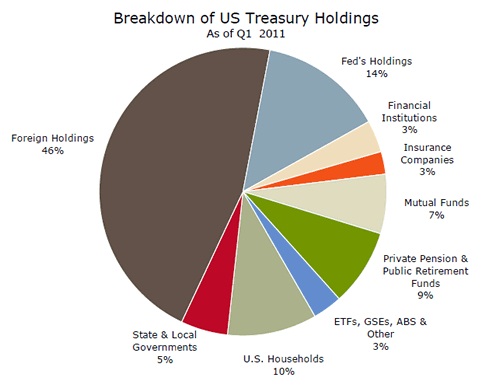

Will financial markets rush to sell U.S. Treasuries in the wake of a downgrade? Not likely although economists have been debating on this issue for many moons. It’s quite simple – this Treasury Monster is “Too Big to Fail”, not to mention the fact that foreign holdings make up the largest share of outstanding Treasury security holdings. Of all foreign Treasury holdings, more than three quarters is held by foreign official institutions which include foreign sovereign wealth funds and central banks.

These institutions hold U.S. Treasury bonds because they are the most stable and the most liquid financial asset in the world so even if they would dump it after a downgrade, they would have difficulties finding replacement(s). One option would be for these institutions to park their money in European debt but the Eurozone itself has been rocked by its own credit worthiness from the sovereign debt crisis. Another option would be Asian debt as a replacement. But Asian countries’ capital markets are still developing and not yet mature, not to mention it’s too small to replace the giant U.S. Treasury market. The foreign funds holding about 46% of U.S. Treasury will have no where to go but to stay put.

3) Money Market Funds will Stay As It Is

Besides putting their money into savings accounts at commercial banks, Americans put their money into money market accounts namely money market funds. A money market fund is a type of mutual fund that is required by U.S. law to invest in low-risk securities such as government securities, certificates of deposit, commercial paper of companies, or other highly liquid and low-risk securities. Thus, these funds have relatively low risks compared to other mutual funds and pay dividends that generally reflect short-term interest rates.

U.S. regulations allow for the securities held in money market funds to include a broad band of ratings – from triple-A (AAA) to single-A (A). The U.S. would have to be downgraded several notches, far beyond what either S&P or Moody’s were expected to do before money market funds are affected in a serious way. Nevertheless as the Aug 2 deadline approaches, the Investment Company Institute just revealed that total U.S. money market mutual fund assets fell $37.53 billion to $2.634 trillion for the week that ended Wednesday.

4) Pension Funds, Too Small to Create Impact

5) Germany Bonds Rally

German 10-year bonds rose a fifth day before an Italian debt sale and after Standard & Poor’s said Greece risks further defaults after the restructuring agreed upon at a summit last week. Also, triple-A rated paper like German Bunds and UK Gilts outperformed U.S. Treasuries, with the U.S./German 10-year yield spread 13 bps wider on the day at 35 bps. Using the same analogy, the German bonds would rally in the event of a downgrade.

Investors seeking diversification and shelter will most likely park some of their money in Germany. Sure, the Germany bonds are still small relatively to U.S. but this also means a possible squeeze, pushing German bonds further north.

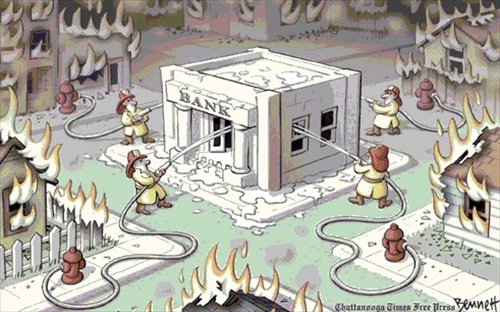

6) Some Banks Get Downgraded

Banks that currently enjoy higher ratings because they’re backed by the government and should there be problem they would get bailed. But now their “guarantor”, the U.S. government, is downgraded so naturally these banks would get downgraded as well simply because the U.S. debt is riskier. These banks may need to raise their borrowing costs. Debt of Fannie Mae, Freddie Mac, the ‘AAA’ rated Federal Home Loan Banks and the ‘AAA’ rated Federal Farm Credit System Banks may be affected.

Heck, these banks may need to raise hundreds of billions in new capital should things get ugly as they aren’t required to hold any capital at all against U.S. Treasurys at this moment but a downgrade means their assets are now not risk-free.

7) Junk Stocks Sell Off, Quality Stocks Bargain

Investors would need to rebalance their portfolio in the event of a U.S. debt downgrade and the most feasible thing to do is to sell off junk stocks, if they have any. A decline of 2% – 5% (some say 10%) in the S&P 500 across the board is also anticipated with stocks such as Coca-Cola to Apple Inc. to be affected, one way or another. Already, many are chasing out just in case as can be seen when the Dow is down by 441 points this week alone.

When rating agencies downgrade countries — as we’ve seen with Spain, Greece and Japan – their stocks tumble. Having said that, FinanceTwitter still think this is a golden opportunity to scope the quality stocks during the sell-off. Reason – 80% of the 190 companies in the S&P 500 that have reported second-quarter results have beaten Wall Street’s estimates. Earnings from Microsoft Corp., Coca-Cola Co. and IBM Corp. had the Dow above 12,700 just a week ago.

Like it or not, a downgrade in the U.S. wouldn’t have the same effect on its stock market as downgrades do in other countries. The companies in the Dow are giant-multinationals that rely less on the U.S. for profits as compared to companies from Spain or Greece. For example, Apple’s iPhone sales actually quadrupled from a year ago in the Asia market particularly China. Therefore, assuming investors already take into consideration of a one-notch credit downgrade of U.S. debt, the stock market may celebrate upon an agreement to lift the debt ceiling, and you won’t want to miss this chance, would you?

Interestingly, according to U.S. Treasury, U.S. Government had an operating cash balance of only $73.8 billion at the end of the day yesterday. On the other hand, Apple’s last earnings report showed that the company had $76.2 billion in cash and marketable securities at the end of June. This is amazing but it’s a joke the world’s largest and (perhaps) the most admired technology company has more cash than the world’s largest sovereign government – United States of America. Maybe Steve Jobs can organize a short course on how Apple Inc. (NASDAQ: AAPL, stock) earns more money than it spends to the U.S. government, which does the opposite.

No comments:

Post a Comment